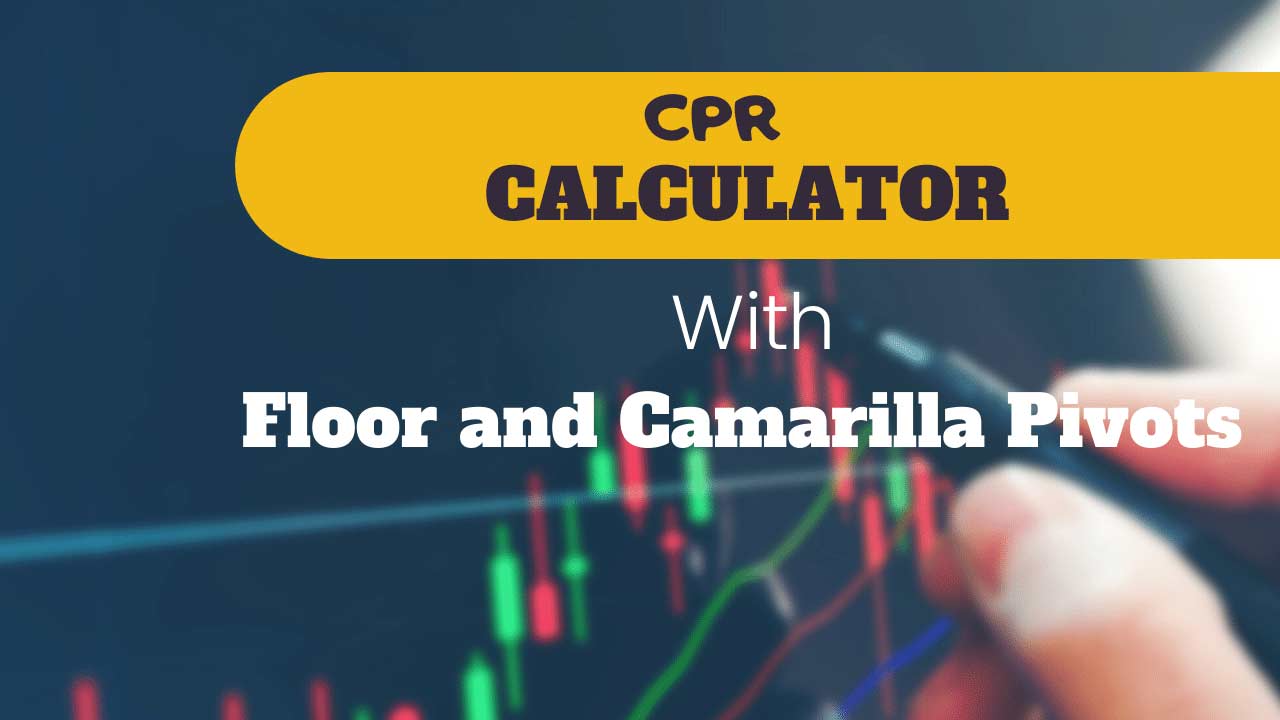

Central Pivot Range, Floor and Camarilla Pivot Points CalculatorHigh*Low*Close*Enter the values above

Here's a list of posts that our readers visit frequently:

![Weekly Narrow CPR Stocks [Complete List] weekly narrow cpr stocks](https://www.cprgyan.in/wp-content/uploads/2022/01/weekly-narrow-cpr-stocks.jpg)

![Daily Narrow CPR Stocks [Narrow CPR Stocks For Tomorrow] dailly narrow cpr stocks](https://www.cprgyan.in/wp-content/uploads/2022/01/Daily-narrow-cpr-stocks.jpg)

![Monthly Narrow CPR Stocks [Complete List] monthly narrow cpr stocks](https://www.cprgyan.in/wp-content/uploads/2021/12/Monthly-Narrow-CPR-Stocks.jpg)

Here's a list of posts from our blog on various topics related to the Stock Market

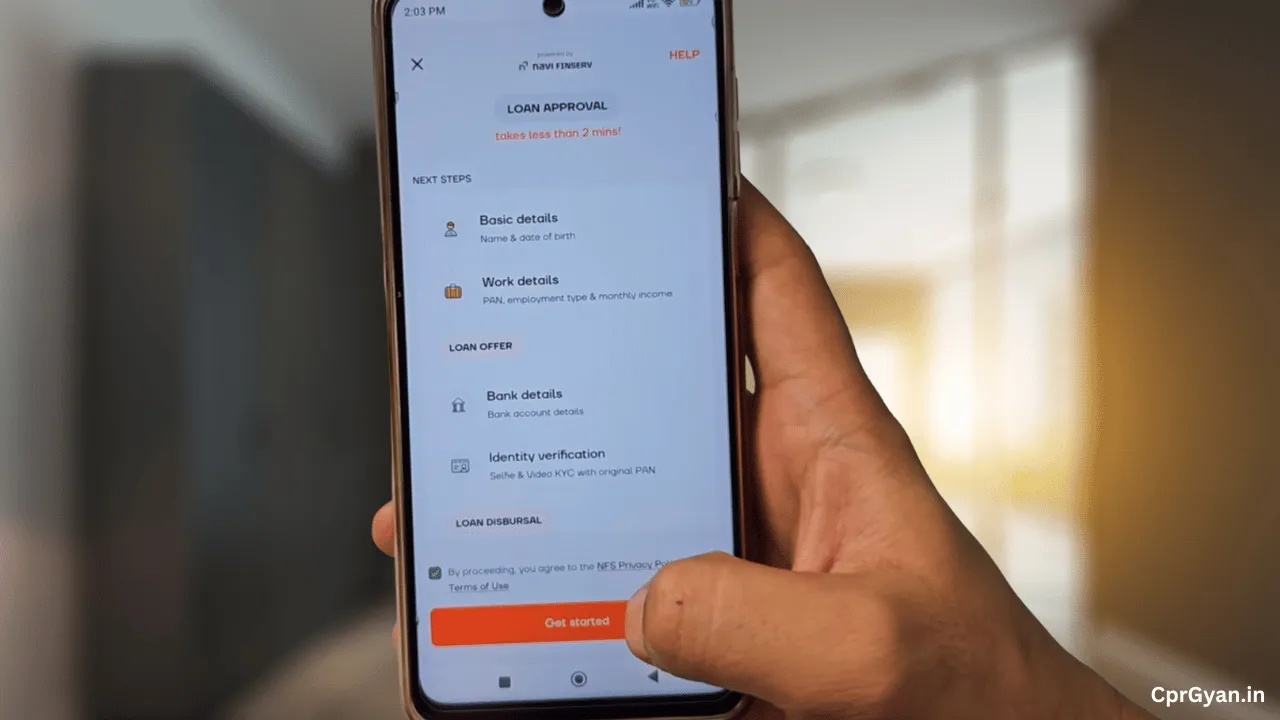

At Cprgyan.in we provide knowledge regarding the Indian Stock Market, Investment and Loan. Here we cover each and every topic related to stock market, investment and loans from basic to advance level.

We have noticed that many people are nowadays jumping to finance world with their hard-earned money without any proper knowledge or guidance. Our sole purpose is to provide the right knowledge to every individual.

Enter your text here...

Follow Us on Social Media

Copyright @ CprGyan 2024