In an age where your financial data is just as valuable as gold, trust is not a word you throw around lightly. Let’s talk about Cred App—a slick platform that resembles the Apple Store of credit management.

With sumptuous rewards and flashy user interfaces, Cred has created a buzz unlike any other in finance apps. But just like you wouldn’t jump into a mysterious, shimmering lake without knowing its depth or what lurks beneath, should you dive headfirst into Cred without checking the safety labels?

Your credit score, hard-earned money, and financial future are on the line. Wouldn’t you want to know if Cred App is the Fort Knox of credit management or just a candy-coated Trojan Horse?

Grab a seat and some popcorn; we’re about to open the vault of information you’ve been searching for. Stay with me, and let’s explore the million-dollar question: “Is Cred App Safe?”

What is Cred App?

In the world of credit management, Cred App emerges as a guiding light—a mobile beacon designed to cut through the complexities of credit card bill payments.

Imagine an app where you can promptly pay off your credit card bills and get showered with cashback coupons and reward points for your punctuality. Yes, Cred App makes being financially responsible almost… glamorous.

What sets Cred apart in this crowded marketplace? While many banks and Non-Banking Financial Companies (NBFCs) offer their own apps to simplify payments, Cred adds an extra layer of user-friendliness with its unique payment approach.

Also read: NAVI Loan app review

Unlike traditional financial apps, Cred supports virtually every bank and financial institution, serving as a one-stop hub for your credit needs.

Users can make seamless payments for multiple credit cards by linking their mobile numbers, enjoying a streamlined and secure transaction experience that many find easier to navigate than competing platforms.

Cred App is not just another bill-paying app; it’s a holistic credit management ecosystem that rewards you for sound financial behavior while making the whole process as effortless as possible.

Also read: Best bank for salary account

The Benefits of Paying your Credit Card Bills using Cred App:

Ah, the alchemy of turning a chore into a celebration—that’s what Cred App accomplishes for credit card bill payments. Gone are the days when settling your credit card dues felt like an obligatory, mundane task that you’d sooner forget.

With Cred App, each payment morphs into an opportunity, a doorway to an array of compelling benefits that are hard to ignore. First on the list is the irresistible lure of cashback coupons and reward points. Pay your bills on time, and you’re essentially getting paid, thanks to the lucrative rewards system.

But the advantages extend beyond the glittering incentives. The app is a unified portal for managing multiple credit cards across various banks, streamlining your finances in one accessible platform.

Are you worried about forgetting your payment deadlines? Cred App’s timely reminders have your back. Furthermore, it adds an extra layer of security to your transactions, making it a fortress for your financial data.

Also read: Where to invest 50000 rupees in India?

Here are some of the benefits of using Cred app to pay your credit card bills:

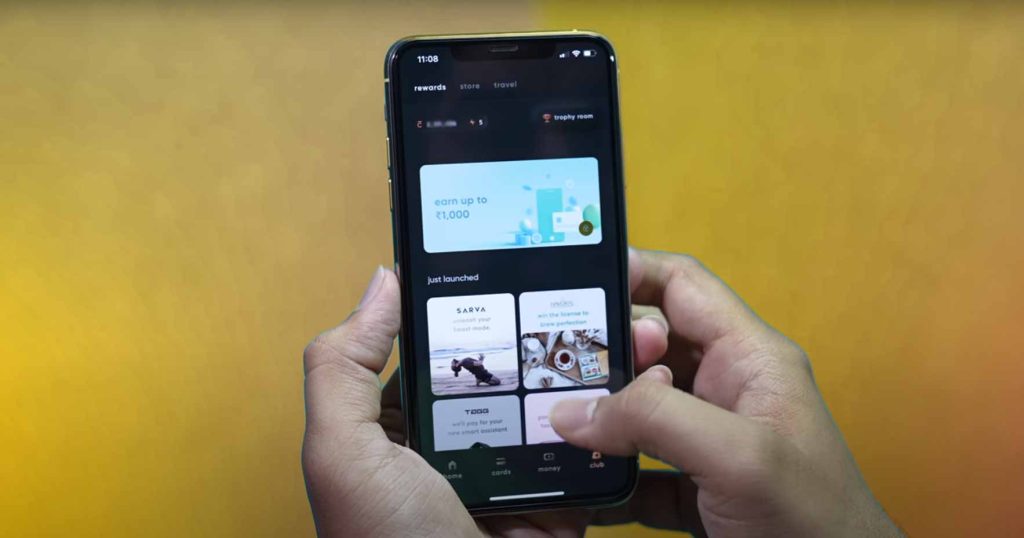

1. Rewards Galore:

Cred isn’t just an app; it’s an exclusive club. At the time of writing, Cred is members-only, and membership comes with its own set of opulent perks.

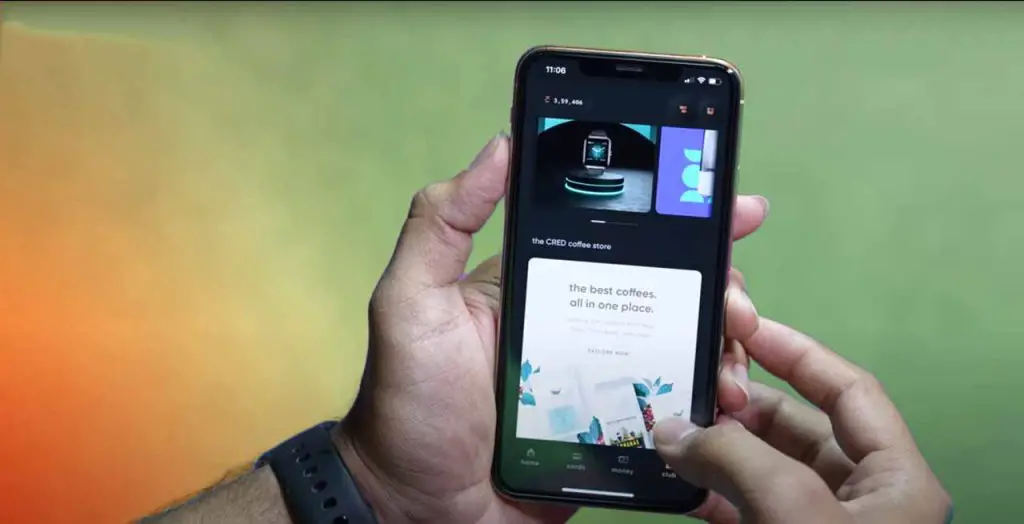

Pay your credit card bills via the app, and you’ll be showered with Cred coins—digital tokens you can use to purchase products at reduced prices right within the app. Think of it as a VIP lounge for financial responsibility!

2. Instant Cashback:

But wait, there’s more! Paying off your credit card balance on Cred doesn’t just earn you Cred coins; it also generates cashback rewards instantly credited to your account. It’s like the universe’s saying, “Great job adulting!”

3. Smart Payment Analysis:

Ever look at your credit card statement and wonder where all your money went? Cred categorizes your expenses, giving you a roadmap of your spending habits. This simplifies your financial life and clarifies where you might want to cut back.

4. Simplified Statements:

Credit card statements can feel like they’re written in an ancient, indecipherable language. Enter Cred Protect—a feature that decodes your statements into a more straightforward, more digestible format and emails them to you, password-protected for your security. And linking your email is entirely optional; you’re in the driver’s seat here.

5. Automatic Payments:

For those juggling multiple cards, Cred offers an auto-repayment option. Link a payment method once, and voila! Your bills will be paid automatically when due. Want to stay updated? Opt for automated notifications via WhatsApp and keep track effortlessly.

6. Credit Score Insights:

Why download another app to keep tabs on your credit score when Cred can do it all? Use your earned credit coins to get detailed credit score reports. But that’s not all—Cred also offers invaluable tips to improve your credit score, providing insights into credit utilization, repayment trends, and more.

7. Exclusive Offers:

While most of us are oblivious to the various offers our credit cards provide, Cred lays them out on a silver platter. The app showcases all available offers, ensuring you’re not leaving any value on the table.

Cred App is more than a bill payment service; it’s a comprehensive financial tool designed to enrich your credit management experience.

Whether earning rewards or understanding your spending better, Cred has something for everyone. And that’s why knowing whether it’s safe becomes crucial— once you start using it, you’ll wonder how you ever managed your credit without it.

Is Cred App Safe to Use?

Let’s address the elephant in the room—the all-important question of safety. As feature-rich as Cred App is, handing over your credit card details to a third-party application can feel like a tightrope over a pit of potential risks. But regarding Cred, the safety net appears robust and reliable.

Firstly, Cred is no rogue app operating in a legal gray zone. It complies with Data Security Standards (DSS), meeting the minimum safety requirements to ensure your credit card information remains in Fort Knox-like security.

Adding another layer of protection is its 256-bit encryption—a level of security often employed by financial institutions and military organizations. Cred is also verified by the National Payments Corporation of India (NCPI) for an extra stamp of legitimacy.

UPI Payments? Covered. Cred has joined forces with Axis Bank to facilitate UPI transactions, adding another layer of trust to its financial operations. Concerned about your email privacy?

Cred may have access to your Email IDs, but their privacy policy limits their scope to finance-related emails concerning Cred, banking, and mutual funds. Your emails are off-limits.

Still not convinced? Consider this: Cred’s track record is spotless, with no significant security breaches or complaints against it. Online reviews overwhelmingly support its legitimacy.

Therefore, if you’ve been holding back from diving into the rewarding world of Cred out of safety concerns, it may be time to reevaluate. Rest assured, with Cred, you’re in secure hands.

Who Can Use the Cred App?

So, you’re enticed by the plethora of perks Cred App offers and are wondering if you can jump on this financial joyride. Let’s demystify the eligibility criteria, shall we?

Contrary to what you might think, Cred is not an all-access party; it’s a carefully curated club catering primarily to the creditworthy residents of India. Becoming a member is like applying to an elite school—you fill out a digital form and wait for the golden approval.

Here’s the rub: Cred is looking for people who have already demonstrated financial responsibility. A good credit score is your VIP pass into this exclusive realm.

You will probably get approval if your credit score stands at 750 or above. Age-wise, it would help if you were at least 18 to be considered for Cred membership.

So, it’s not just about wanting to simplify your credit card payments; it’s about proving that you’re someone who can manage credit well in the first place. In other words, Cred rewards good financial behavior and offers its platform as an incentive to maintain or even elevate that.

Once you’re in, the onus is on you to make timely payments. But with all the features geared towards making this as easy as pie, you’ll wonder how you ever managed your credit without it.

How Does the Cred App Work?

Now that we’ve established who Cred is for and why it might be a safe bet for your financial management, let’s get down to the nuts and bolts—how does this app work? If you’re imagining a labyrinth of complex processes and intimidating jargon, prepare to be pleasantly surprised.

Using Cred is as straightforward as it gets, neatly encapsulated in a four-step journey.

Step one is your application to join the high-flying Cred club. Please fill out the digital form, submit it, and voilà! You’re in the running.

Once your application garners approval, you unlock the gateway to streamlined credit card payments. Just link your cards and start paying your bills via the app.

Here’s where the magic happens: Each bill payment isn’t just a financial obligation met but a treasure trove unlocked. You earn reward points and cashback with every bill paid.

Finally, what to do with these hard-earned rewards? You’ve got options. You can transfer the cashback directly into your bank account or use your reward points to snag coupons and buy things at discounted prices.

How Can CRED Help You to Improve Your Credit Score?

Ah, the elusive credit score—a three-digit number that can open doors to financial freedom or keep them frustratingly locked. We’ve already explored how CRED can simplify your life in multiple ways, but did you know it can also be your trusty sidekick in the quest for a better credit score?

Imagine having the ability to check your credit score anytime you want without incurring any additional charges. CRED offers precisely that. The app features a “Refresh Score” option that keeps you up-to-date with your latest credit score and equips you with actionable insights to improve it.

But CRED doesn’t just give you a snapshot; it provides a complete, detailed picture. It pinpoints the areas affecting your credit score negatively, offering you a roadmap to credit score nirvana. Work on these highlighted terms or elements, and you’ll not just be playing the game but also acing it.

By aligning your financial behavior with the app’s recommendations, you can boost your score and enhance your creditworthiness.

Think of CRED as a personal credit score trainer that doesn’t just show you the numbers but helps you understand them and guides you toward improvement. With CRED, you’re not just tracking your credit score but actively elevating it.

Conclusion:

Throughout this post, we’ve delved into the inner workings of the CRED App, from its ability to simplify credit card payments to value-added rewards and credit score monitoring features. But the most vital concern we addressed is the safety aspect.

As the digital landscape expands, the age-old adage “Better safe than sorry” has never rung truer. CRED has built its foundation on a robust compliance framework, multiple layers of encryption, and a crystal-clear privacy policy.

However, one can’t help but ponder a broader question: In our relentless pursuit of convenience, are we not becoming too comfortable handing over critical personal information? Could we be setting ourselves up for unprecedented vulnerabilities in the long term, even with currently considered safe apps?

Remember, trust is not a constant; it’s a variable. The dynamics of cybersecurity are ever-changing, constantly evolving to outwit and outlast new threats. Today’s secure vault could be tomorrow’s Pandora’s Box, and staying vigilant is not an option—it’s a necessity.

So, while CRED has demonstrated a high level of security and value, the onus remains on you, the user, to continually assess the safety of your data in an increasingly digital world.

CRED simplifies, rewards, and educates, but it also serves as a poignant reminder that in the age of convenience, our most significant commodity isn’t money or credit scores—it’s trust.

So, as you venture into the rewarding ecosystem of CRED, it’s wise to remember that while technology can secure your data today, your vigilance secures your future.

FAQs

What measures does CRED take to ensure the security of my credit card information?

CRED employs multiple layers of security, including 256-bit encryption, to ensure that your credit card information is secure. It is also compliant with DSS (Data Security Standard) and is verified by the NCPI (National Payments Corporation of India). For UPI payments, CRED has partnered with Axis Bank, further reinforcing its commitment to safety.

Does CRED have access to my emails?

No, CRED only accesses finance-related emails that pertain to the CRED app, banking, and mutual funds, according to its privacy policy. It does not have access to your emails, ensuring a layer of privacy between your personal life and your financial transactions.

Has CRED ever had a security breach?

As of the information available, there has been no significant security breach or complaint against CRED. Reviews online also indicate that the app is generally considered safe and secure for managing credit card payments and rewards.

Can I opt out of linking my email to my CRED account?

Yes, linking your email to your CRED account is entirely optional. The Cred Protect feature provides a simplified version of your credit card statement and sends it to your email if you choose to link it, but this is not a mandatory requirement for using the app.

What should I do if I notice suspicious activity on my CRED account?

If you notice any suspicious activity on your CRED account, it’s crucial to contact CRED’s customer support immediately. Simultaneously, review your linked bank and credit card statements for unauthorized transactions. It’s also a good practice to change your passwords for added security.