In this article, we will discuss what is trigger price? Trigger price meaning with examples. If you trade in the Stock Market you may have heard this term many times, but many of us still do not know its actual meaning and importance.

What is trigger price? Trigger Price Meaning with Examples

Triggers are actions that are defined in the trading platform. They can be used to automate some of our trading tasks, such as placing orders, setting watchlists and alerts.

For example, A trader may define a 'Buy' trigger in the trading platform that when the price reaches a certain level it will automatically place an order to buy at the market.

Similarly, a trader may define a 'Sell' trigger in the trading platform that when the price reaches a certain level it will automatically place an order to sell at the market.

Trigger Price is defined in terms of an instrument's price.

Also read: What is Expiry in Share Market?

How does trigger price work?

The trigger price is the lowest possible price at which a share should be executed.

A trigger price is an instruction to buy or sell security automatically when its price reaches the trigger level.

It is often used in the context of stop-loss orders where a trader wants to automatically exit a trade when its price falls below a certain point.

This may be due to market volatility or lack of interest, and any price that offers some protection against this will surely be welcome.

While it can seem like trigger prices are just random numbers, obviously, there is some science involved.

Trigger prices are usually calculated using data from the stock’s historical trading range to create a point where it may be deemed undervalued or overvalued when compared to its average price during that timeframe.

In this way, trigger prices can help traders avoid being stuck with an asset they do not want.

Trigger prices can work for both buyers and sellers, but they are most commonly used to automatically sell stocks when their price falls below the trigger level - essentially setting a stop-loss order.

This is helpful because it ensures that the shares will be sold even if the trader has dozed off or left his computer unattended.

Is trigger price and stop-loss same?

Trigger price and stop-loss are not the same.

While both of them can be used to automatically sell or buy shares, trigger price is a calculated number while stop-loss order is an instruction in which you tell your broker how much you want to lose before selling off all your holdings in that particular stock.

For instance, if you want to buy shares of ABC company and you don’t want your investment to go any lower than Rs 1000 per share, then you will set a stop-loss order at that price.

However, if the trigger price is based on historical data, it may indicate that the stock has reached its lowest point in history (and therefore there is no point selling yet) or it could be an indication that the stock is overvalued and you should exercise caution.

So while the stop-loss order gives clear instructions about how much to invest, the trigger price goes one step further to indicate whether the investment may actually yield results.

It comes in particularly handy when considering investments with high volatility as they are more likely to go beyond the specified trigger price.

The best way to make sure you are making a wise investment is by considering both factors before putting your money in any company.

Trigger prices can be calculated using various algorithms, but they all use historical data which makes them very accurate indicators of how much an asset may rise or fall in the future.

However, this doesn’t mean that you can use trigger price to predict the stock market; for that, you will need a crystal ball!

Trigger prices are calculated using algorithms that take into account various factors like sentiment analysis and supply/demand in order to determine whether an asset is overvalued or undervalued at any given point in time.

Trigger prices are best used when you want to automatically re-balance your portfolio or sell off assets that have become overvalued (or undervalued) without having to monitor the market all day long, every day of the week!

So don’t worry about trigger price and stop-loss being too different; they both serve an important purpose in making sure your assets yield the best possible returns!

Also read: Jobber in Stock Market? Meaning, Work and History

What is trigger price in Intraday trading?

Trigger price in Intraday trading is a tool that helps traders exit their trades when its value falls below or rises above certain points.

This can be due to market volatility or lack of interest. It’s important to remember though, not all triggers are the same.

The most common types of triggers used are stop-loss, take-profit, and price alerts.

Stops and limits work in the same way, by placing a limit on any potential losses.

The difference is that stops are set below current prices to protect against price falls while limits are placed above current prices to prevent further purchases if the market continues rising.

Take-profit triggers can be either similar to stop loss or limits.

If set below current prices, it automatically closes the trade if price falls. If set above, they would close the trade in case of any price increase.

Price alerts are also known as “automated triggers” since all you need to do is define when and how often you want them sent out via SMS or email.

Also read: What is CE and PE? Meaning, Full Form with Examples

What is trigger price in Crypto?

Trigger price in Crypto is the lowest or highest limit order that can be placed for buy and sell orders. If the trigger price is not set, it will automatically default to the current best bid/ask at market price.

The trigger price for a buy order should be set below the current market value, and it will remain on hold until triggered.

The trigger price for a sell order should be set above the current market value so that your sale can execute immediately when another trader places an appropriate buy order at your trigger price.

A trigger price in Crypto and Stock market is used to set a limit on the trading price. The purpose of trigger price is same for Crypto and Stock market which is to ensure a better price for an asset.

In other words, the purpose of trigger price in trading is to make sure that you do not sell or buy at a loss while executing your order/trade on the exchange platform.

Trigger prices are very useful when there’s low liquidity because it will automatically set a limit to avoid “slippage”.

Slippage means that you are unable to enter your order successfully due to the low liquidity in an asset's trading market, which causes unexpected price movements while trying to buy or sell.

Trigger prices can be set at any desired value i.e., higher than the current exchange rate, lower than the current exchange rate, or at multiple values of your desired trading amount.

Trigger price set for sell orders are called “Stop-loss” and trigger prices for a buy order are referred to as "Limit-orders".

The Stop-loss limit ensures that you do not lose money when selling an asset since it automatically sets a lower-priced limit on your sale order.

A limit order sets the price at which you are willing to buy an asset, and if that price becomes available it will automatically execute your trade.

Limit Price is set for both Buy & Sell orders in Crypto Market but only used by traders to sell their assets when they think its value has gone down too much or vice versa.

Trigger price in Crypto enables a trader to automatically enter into a trade when the market moves, and then to get out of the trade if it moves in the opposite direction.

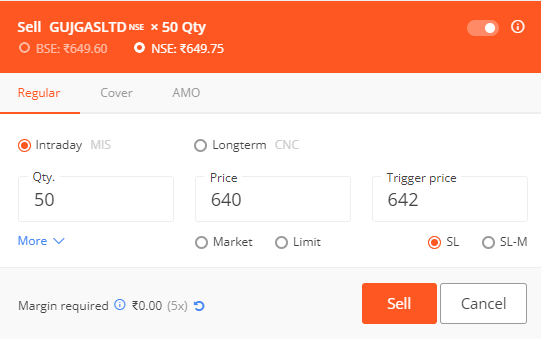

What is meant by trigger price in Upstox?

A trigger price in Upstox is the price that you set manually in your Upstox trading platform to either enter into a stock or exit from a stock.

You can set a Limit order with a trigger price to book your profits and set a stop-loss order with a trigger price to cut your losses.

What is trigger price in Zerodha?

When you put buy or sell orders on an exchange, the actual price at which those orders will be activated for execution at the exchange servers is the trigger price. In other words, as soon as the stock's price reaches the trigger price you specified, the order is transmitted to exchange servers.

The limit price is the price at which your shares will be sold or purchased once the stop-loss order has been activated.

The stop loss (SL) order consists of two price components.

- The stop-loss price, also known as the stop-loss limit price, is the price at which you sell your position.

- The stop loss trigger price is referred to as the trigger price.

For a better idea, please see the example below.

When the stock price reaches Rs 642, your order will become live, which means it will be activated. Then a limit order of Rs 640 will be sent to the exchange. So, if the buyers are available then the stock is sold at Rs 642 or lower.

A stop-loss order is an inactive order. To activate it, we must set a trigger price. A trigger price is a price level that activates a stop-loss order, which changes from a passive to an active order after crossing the trigger price.

Also read: Can I sell delivery shares on same day? Zerodha, Upstox and Angel Broking

Conclusion

The trigger price is a useful tool that can be used to protect you from incurring any loss when buying or selling assets.

It’s a way to automatically enter into a trade when the market moves and then get out of the trade if it moves in the opposite direction.

Hope you have understood What is trigger price and its meaning.

Thank you for reading this post, do leave your valuable feedback in the comment section below! Have a good day ahead!

FAQs

Trigger price meaning in Hindi

Trigger price एक उपयोगी feature है जिसका उपयोग shares खरीदने या बेचने पर आपको किसी भी नुकसान से बचाने के लिए किया जा सकता है। जब बाजार चलता है तो यह स्वचालित रूप से एक trade में प्रवेश करने का एक तरीका है और यदि यह विपरीत दिशा में चलता है तो trade से बाहर निकल जाता है।

Trigger price meaning binance

The Mark Price is used by Binance as a sell trigger and to calculate unrealized profit and loss. The Mark Price is typically several cents lower than the Last Price.

Trigger price for buying

When you are looking to purchase a share, instead of buying at market price you can place a trigger price to buy. Once the price is triggered your buying order will be executed.

Trigger price meaning in Upstox

A trigger price in Upstox is the price that you set manually in your Upstox trading platform to either enter into a stock or exit from a stock.

Trigger price meaning in Zerodha

A trigger price in Zerodha is the price at which you manually enter or exit a stock in your Zerodha trading platform.

Trigger price vs limit price

A trigger price is different from a limit order; the limit order allows you to enter into or exit out of trades at a specific price level. A trigger order allows you to enter into or exit out of trades as soon as the price reaches that particular level and trigger your price.